Tangible Things - Part 2: Currency Woes

This is Part Two of a three part series that takes a deep dive into the current economic situation we find ourselves in in this country and what we can do to prepare for what's ahead.

[Author’s Note: This is Part Two of a three part series that takes a deep dive into the current economic situation we find ourselves in in this country and what we can do to prepare for what’s ahead. Even if you slept through economics in high school, you should still get some actionable info out of this series. At the very least you’ll hear a different perspective from the talking heads on TV and social media!]

If you haven’t done so yet, you’ll want to read Part 1 first.

Part 2

Currency Woes

As outlined in Part 1, the asset bubble we’re in today was born in 2010 when interest rates went to zero. That is a 12-year-old bubble folks. It is massive.

The bubble has been nurtured year after year from the nectar of free money thanks to the Federal Reserve. When the cost of money is cheap (Federal Funds Rate at 0%) people and businesses borrow more to spend more. More money in the system drives up asset prices. As prices on traditional assets start getting pricey, rates of return decline so in order to make a better return, money flows into assets previously considered risky.

Did you say “risky assets”?

Yep. Time to queue up cryptocurrency…

Have you noticed how the big investment banks, JP Morgan, Goldman Sachs, Morgan Stanley, etc. all have crypto trading operations now? This is even more interesting when you realize that the CEO of JP Morgan, Jamie Dimon called Bitcoin a “fraud” and said he would fire any of his employees caught trading Bitcoin.

Ah, how times change, especially when there is money to be made!

Cryptocurrency is a bit of a hot button for some people. They either love it, hate it, or don’t understand it. I’ll be the first to admit that the idea of decentralized currency - something not under the control of the central banks of the world, really appeals to me. I understand the technology and the appeal of blockchain. In fact, I’m still thinking about how an electronic distributed ledger could be used with AmmoSquared for overall inventory transparency (not individual accounts). Also, we’ll soon add a way to pay for ammo with Bitcoin - so just to be clear: I’m not anti-crypto and even own a tiny, tiny, fraction of a single Bitcoin (LOL pathetic chuckle…)

That said, what isn’t good about Bitcoin if it were to be used as an actual currency, are the massive price swings. It makes it all but unusable except by speculators.

I’ll give you 10,000 BTC for two large pizzas… hold the mushrooms please.

Back in 2010, that was in fact, the first commercial exchange of BTC for physical goods: two pizzas from Papa Johns (I’m not sure about the mushrooms though). At today’s BTC to USD exchange rate, that amount of Bitcoin would be worth $295,140,000. That is a lot of pizza!

That exchange also highlights the problem: while BTC and other crypto currencies can act as a medium of exchange, they don’t provide a stable store of value. I know you are thinking, “Hey that looks like a pretty good store of value to me… in 12 years the value of BTC went way up and now you could buy enough pizzas to last a lifetime! (14.7m pizzas to be exact).

Yes, that is for someone that owned BTC back in 2010 - before the Average Joe knew anything about it. It was a great speculative play, but what about today? If you look at a 5-year BTC/USD chart you’ll see a big run up, then huge swings in relative prices over 100%:

Do you have much confidence that the value of BTC will be anywhere near today’s price in 6 months? How about 6 years? It could be 10x higher or 1/10th today’s price. And that is Bitcoin, the crypto “king”, the coin that most people in the industry agree is the safest bet.

But what happens when confidence is lost in a particular coin like we saw with Terra? If you don’t know what I’m talking about I’ll give you a little background. Terra (UST) is a stable coin that is supposed to maintain its value at $1 through complex algorithms by buying and selling LUNA - another associated crypto, but instead UST recently dropped precipitously to (as of today) $0.04. What is worse in this situation is the associated cryptocoin (LUNA) has essentially lost ALL of its value in a very short amount of time.

LUNA dropped from a high of $116.39 on April 4th to $0.000142 today - just a month and a half later. I honestly don’t even know how to say that: “One hundred forty-two then-thousandths of a cent”? Basically it would take 1,000 LUNAs to make 14 cents now. I’m sure anyone buying LUNA when it was over $100 couldn’t even fathom that it could drop so far so fast.

In theory, this could happen to Bitcoin as well… but only IF people lose faith in it and abandon it which, honestly, is very unlikely to happen. I found this article that talks about the LUNA demise and the death of a blockchain:

“Blockchains, then, are fragile financial ecosystems of validators, users, developers, investors and others, with their participation directly linked to the chain token’s well-being and appreciation. The expectation is that as more participants get involved and activity increases, coin values will increase, attracting more users and creating a virtuous circle. But if a chain’s token collapses, everyone’s economic incentive to support the chain evaporates, too. If the loss of value appears to be permanent, only a few ideological fans remain – everyone else leaves. That’s how a blockchain can end up dying.”

When you realize there are thousands of smaller coins out there that could experience a similar quick death if they lose support, then it makes sense to be very cautious and only speculate with what you can afford to lose. If your focus is more of a store of value and not as much speculation, forget about cryptocurrency for now until the price stabilizes.

You could even take that a step further and use the same caution for the overpriced stock market or red hot housing market right now - both are headed for a massive correction if you believe Michael Burry.

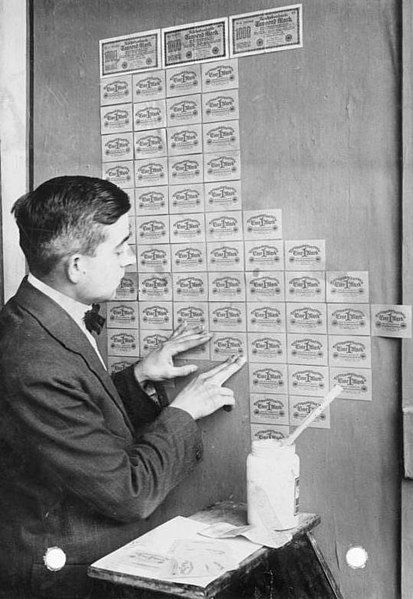

But here is the kicker: when you stop and think about it, just like any cryptocurrency, if trust and support dries up, the same thing could happen to the good ‘ol US Dollar as well - or any fiat currency like the Yen, Euro, or Pound. I know this is crazy talk, but I’ll bet you don’t know anyone who is holding currency from the Weinmar Republic today… that is because it no longer exists - hyperinflated away.

It was printed until the only thing it was good for was… wallpaper.

Just like Weinmar Republic, the The US Dollar (along with every other fiat currencies for that matter) is backed by, well… nothing.

If you go into a bank and demand they exchange your Federal Reserve Notes for “real money” they’ll laugh at you, then probably call the cops for making a scene. That’s because a dollar doesn’t have a fixed exchange rate with anything tangible any more. It did. Before 1971, you could exchange 35 Federal Reserve Notes for 1 ounce of gold, until Nixon took us off the gold standard.

This act brought an end to the 1944 Brenton Woods Agreement where the US Dollar was pegged to gold at $35/oz and other countries pegged their currencies to the Dollar. It was a vote by the international community in the strength of the United States at the end of WW2.

Why did Nixon, in his infinite wisdom, suspend the gold standard? Simple, we couldn’t afford our international debts any longer. We spent too much on domestic programs (Lyndon Johnson’s Great Society aka “The War on Poverty”) and international shenanigans (aka War in Vietnam). The printing press was running overtime and when other countries wanted to exchange the dollars we sent them for gold (because gold was the currency of international exchange), we started running out of gold.

Of course the obvious solution of spending less was too radical for the Nixon administration. Their answer was to remove the barriers to spending more.

Like today.

There are no longer any checks on our spending. We can electronically “print” money until we are blue in the face and that is exactly what our political leaders are doing.

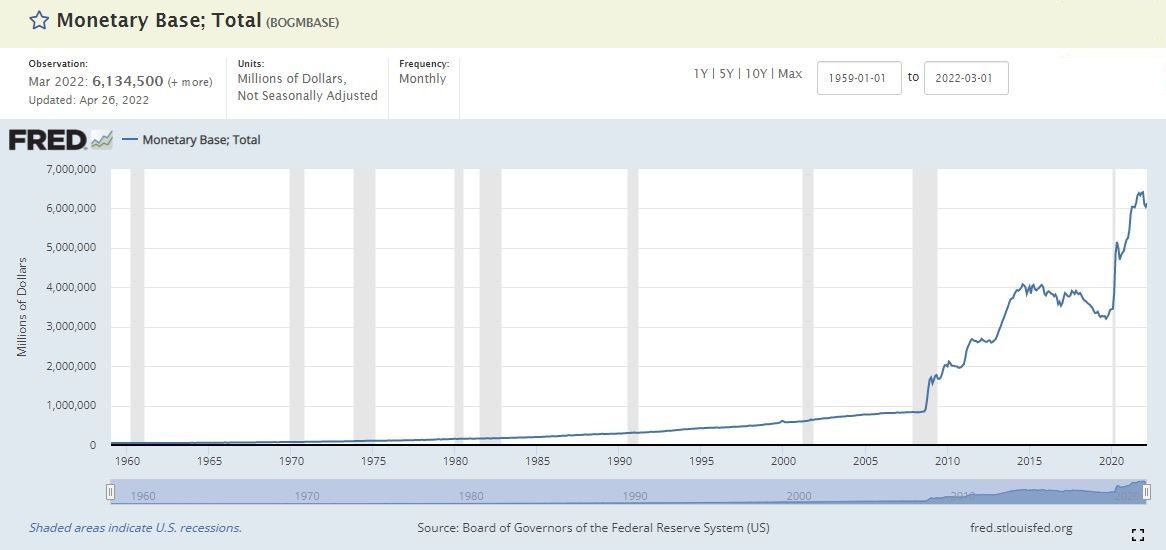

Remember those charts from Part 1 that show the current bubbles started around 2010? Well here is a chart that shows the growth of our money supply (this is just bills and notes in circulation along with deposits in bank accounts) since 1960.

Notice what happens around 2010? Or said another way: How do we tell Nixon “Hold my beer” when it comes to spending and inflation?

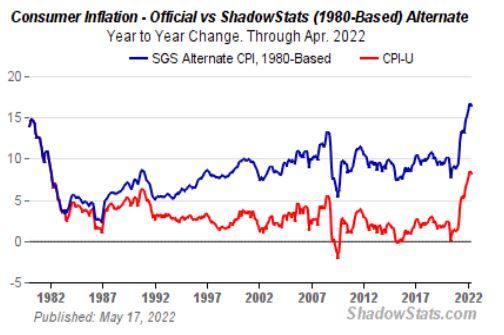

Remember those two pizzas someone purchased in 2010 with 10,000 BTC? The dollar equivalent at the time was $40, now just 12 years later it would take $53 to buy those same two pizzas: a 32.6% increase! That is, if you believe the official inflation rate which I don’t. In case you haven’t found this site yet, Shadow Stats calculates the CPI and inflation rates using the original inputs we used back in 1980, before the government started playing games to make inflation look lower than it actually is. Here is their chart:

As you can see our “official” inflation rate is somewhere around 8.5% but our “unofficial” inflation rate is actually above 15% which exceeds the highest rate in 1980.

So at this point we should change the pictures on our money to Bernie Madoff because we literally have the Madoff Dollar now. Most people don’t realize this but the Fed and current administration are playing Three-Card Monte and hoping that people don’t notice - but the gig is nearly up.

I have one more interesting tidbit then I’ll wrap up this section…

Russia Russia Russia

Russia recently did something interesting that very few people noticed or realized the significance of: They pegged the ruble to gold at the rate of 5,000 rubles to 1 gram of gold. Then they demanded that any country that wants to buy oil, natural gas or any of its other exports needs to pay in rubles and not dollars or euros.

What this did was drive up the demand for rubles and protect it from dropping because it was exchangeable for gold.

Here is a quote:

“What the Russians did was a genius, I hate to say it,” explains Jack Bouroudjian, former president of Commerce Bank in Chicago and now chairman of the Global Smart Commodity Group. “It forces people to go to the Russian central bank and pay gold to get rubles to make the transactions.” The ruble had been trading in the range of 70 to 80 for a U.S. dollar. After the sanctions, it plummeted to 120. “Now the ruble basically recovered, trading 80 rubles to the dollar. And it’s because of the way they pegged the ruble to gold.”

This is bad news for the dollar because it further erodes our dominance as a Reserve Currency. If other countries no longer need dollars then we can’t sell bonds to fund our spending. The only buyer will be the Federal Reserve, and that is a lot like marrying your sister - only bad things can come from it.

Part 2 Conclusion

So let’s take stock of where we’re at right now:

- The US Dollar (and other major currencies) are no longer pegged to anything tangible and are currently being inflated away at an increasing rate. Once faith is lost they could lose value very quickly;

- Crypto is great for speculation, but currently is not a safe store of value;

- Runaway spending and low interest rates have created a speculative asset bubble in housing and the stock market at least two orders of magnitude greater than we’ve ever seen before;

- Interest rates should go up substantially to counter the inflation.

In all likelihood today’s political leaders won’t do the difficult things needed to control inflation (drastically reduce spending, raise interest rates, peg the dollar to gold) and instead will attempt to spend our way out of the problem and implement price controls. Basically, two of the worst things they could be doing.

But you know how this works…

In my humble opinion, we should expect the government to do the wrong thing, that has been the rule rather than the exception. I honestly hope I’m wrong, but from everything I’ve read and the people I follow, who are much more educated on this than I am (a few I have linked to in this series), this is the likeliest action. The result very well could be oppressive inflation, shortages and more unrest.

Hopefully this information is not entirely new to you but maybe it hasn’t been laid out exactly like this before. Internally I’ve called this blog series my “manifesto”. I’m not sure if that is exactly the right word but what I’m trying to do here is lay out all of the disparate pieces of information I’ve collected from different sources and communicate them in a way that I hope will help the reader understand what I’m seeing - for better or worse.

As any other kid from the 80’s would say:

Now with all of the doom and gloom out of the way, it is time for personal action. There are examples we can draw on from history and other countries that will give us all a leg up on what’s to come. I’ll present my research and thoughts on that in Part 3.

Stay tuned.