Pioneers Get The Arrows

There is a saying in business that “Pioneers get the arrows while settlers get the land”.

I was reminded of this recently when one of our press releases got picked by TFB (The Firearm Blog) and they wrote a short article about AmmoSquared. We were happy to see this because we’ve been trying to get on more people's radar, so it was a good development.

Then I got this message from Chris (our CTO) at nearly 10pm my time:

So I got in the comments. Boy what a sh*tshow! I started replying to people and defending our company from the "Negative Nancys" until around 1 o'clock in the morning when I finally logged off to hit the sack.

Situations like this remind me how far out we are from the mindset of the average gun owner. I forget because I'm in it every day and our business model is so perfectly logical to me. Some people, however, are immediately turned off when you start talking about “banking” ammo. To them, it is such a foreign idea that they attack it because it is different.

Even though we've been around for eight years fighting this fight, it still catches me off guard sometimes. We’re a pioneer in this space so we take a lot of “arrows” like we did on the TFB blog. Long term I still believe being a pioneer is good because we are creating a new market for something useful and innovative - not just following the crowd and being a “me too” company.

Short term though, we tend to take some hits with the general public who don’t understand what we’re trying to do with ammunition.

The Status Quo Is Comfortable

The real hurdle is that our company and business model is so fundamentally different from everything else ammunition related out there. The typical ammunition transaction is simple:

Pay money >>> Get Ammo >>> Store ammo at Home >>> Shoot Ammo >>> Buy More Ammo... Repeat. It is simple and comfortable to people who have never heard of anything else.

Even a traditional ammunition subscription service basically follows this same process. When we introduced the “storage” aspect into the flow it was (and still is) very unique and people had a hard time understanding it back then as well.

With all of our new talk of an “ammunition bank account” it has people really thrown for a loop. They don’t know what to think. And unfortunately in today’s short attention span society, they don’t pause to think logically about something new before forming a negative opinion and blasting it in the comments.

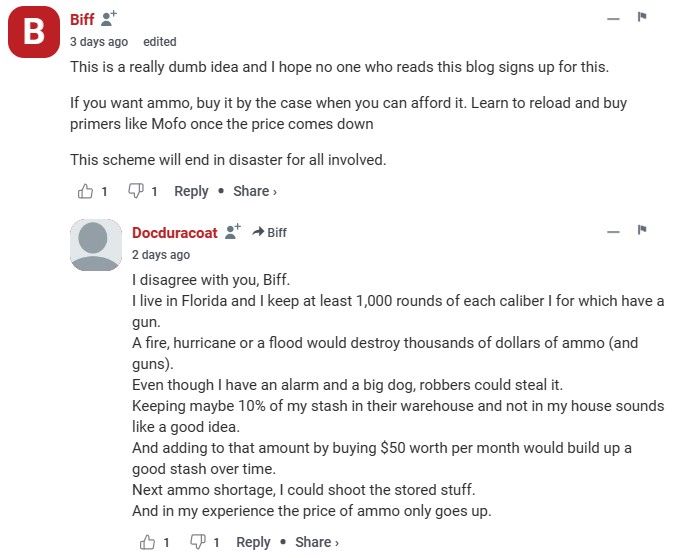

There were a few brave souls that fought back against the general negative tide of the comments section like "Docduracoat" in this exchange:

Docduracoat nails it on the head.

Ammunition Diversification

On top of so many other benefits that I could go into here, but I won’t, we provide AMMUNITION DIVERSIFICATION for our customers.

Can anyone honestly say that diversification of assets is a BAD thing? On the contrary, having all of your eggs in one basket will more frequently end in disaster than spreading out the risk.

When you stop and think about it, we actually provide diversification in more than one area:

First is the obvious one that Docduracoat pointed out - location diversification. If you keep all of your ammunition stockpiled in your home and something happens to your home, you could lose 100% of your ammunition. Pretty simple.

On the other hand if you keep 80% of your ammunition at home and 20% in our secure, climate controlled warehouse, you could still lose 80% of your ammo if you experience a flood or fire at your home, but at least you have another 20% on call at a moment’s notice.

(And yes, the reverse is also true: if AmmoSquared suddenly goes out of business, there is an EMP attack, or SHTF happens you have 20% of your ammunition at risk. But that is the nature of diversification... and if anyone is worried, we've been around 8 years and we're growing so there is no risk of us going out of business any time soon. The other two, who knows but once UPS starts delivering, we'll get shipping!)

The other type is asset diversification. Think of all the wealth you have and the many different ways you maintain that wealth such as money in your bank account, stocks in your portfolio, crypto, gold and silver coins, real estate and of course guns and ammo. No sane person would have everything tied up in one single asset class. It should be spread out so you aren't destitute and living on the street from one major loss.

When you have some of those assets, ammunition in this case, safely stored off-site and, here is the key, exchangeable into cash at a moment’s notice, then you have a new tool for asset diversification. Ammunition can be a small store of wealth compared to the other asset classes, but it is completely independent from your financial assets and other hard assets.

Of course there is no one saying you can’t be like 'ol Biff there and store cases of ammunition in your basement then hopefully turn that into cash in a hurry if you need it. The process is just more labor intensive and time consuming. Whether it is here or there, ammunition can still be an asset.

So while our business model is unique to the firearms community, it is something that has long been standard practice in the precious metals industry (eg: gold depositories). We’re just modifying it and adapting it for use with something we consider more useful: ammunition!

And for that we get arrows hurled at us occasionally like the pioneers of old, but I would rather be on the front line bushwhacking a trail for others than following in a covered wagon dying of dysentery... but that's just me.