Tangible Things - Part 1: Beginnings

This is Part One of a three part series that takes a deep dive into the current economic situation we find ourselves in in this country and what we can do to prepare for what's ahead.

[Author’s Note: This is Part One of a three part series that takes a deep dive into the current economic situation we find ourselves in in this country and what we can do to prepare for what’s ahead. Even if you slept through economics in high school, you should still get some actionable info out of this series. At the very least you’ll hear a different perspective from the talking heads on TV and social media!]

Part 1

Beginnings

If you are older than 30 you likely remember the dot-com bubble. At that time in 1998-2000, it seemed like every internet company on the planet was getting funded by VC’s and going IPO for ridiculous sums of money. A monkey throwing darts could make money in the stock market and for a short period of time, companies and investors were flush with cash. In that magical time companies didn’t need to be profitable, in fact, it was better if they weren’t so they could command astronomical valuations. Instead, all they needed was a grand vision of the future and a Powerpoint deck.

During the dot-com boom, I was working in Silicon Valley California, yep ground zero of insanity, at a small startup called Epigraphix with my wife Danielle. She was a Sales Assistant and I was an Applications Specialist (which basically means I sent out fax ads - yep fax spam!) and made good money doing it. The company was a small investor backed startup with about 20 employees. That company is long gone now - a casualty of the dot-com bubble. Looking back, it was not a huge surprise that it went under, however, a better example of dot-com excess, a company called Excite@Home, was just a block away…

This company was the result of a $6.7 Billion merger between Excite and @Home, and was one of the largest internet company mergers at the time. The campus, which we would walk by on our lunch break, was 500,000 sf of Class A office space that housed thousands of employees. I recall the large @ symbol in the courtyard that was so large you could see it from the air…

Unknown to us at the time, within 18 months that entire campus would be empty and the company bankrupt, its shares going from around $100 to 13 cents - wiping out billions of dollars of paper wealth. And who could forget the multi-million dollar Superbowl ad of a talking sock puppet? Another casualty in the dot-com crash. The history books are littered with similar billion dollar public or venture backed craters from that era: Webvan, Kosmo, Pets.com, Flooz, and eToys.com to name a few.

It would take the NASDAQ SIXTEEN YEARS to recapture its 2000 peak. Millions of people made and subsequently lost fortunes during that time period.

The seeds of the next bubble were sown in the ashes of the dot-com crash. During the recession that followed, the Federal Reserve lowered the Federal Funds Rate from 6.5% to 1%, a level not seen since the recession of 1958. This cleared the way for the housing bubble:

Low interest rates along with particular mortgage lending practices set the stage for the subprime housing debacle starting in 2005. Now, instead of getting buckets of money from VC’s that only cared about going IPO, people were getting buckets of money from banks that only cared about getting paid out for the bundles of mortgages they sold as Mortgage Backed Securities. They weren’t holding on to them so why vet the borrowers? Everyone was making money so everything was hunky-dory…

Do you remember NINJA loans? These aren’t loans to masked assassins, they were much more dangerous: loans given out to someone with No Income, No Job, No Assets. Yep that’s right, it was a thing back then, circa 2006. Mortgage brokers didn’t care if you even had a way to pay for the loan since you were probably going to flip the property within a month anyway, or in some cases I remember, houses that weren’t even built yet.

Well, as history showed us, the whole house of cards started collapsing when interest rates were ratcheted up in 2007.

In an effort to “take away the punchbowl” as the party was getting to farm-animals-in-the-swimming-pool level of crazy, the Fed raised interest rates to 5.25% and all of the adjustable rate mortgages started getting really expensive. We all know the resulting crash because most of us lived through it. When you have 5 houses with “no money down mortgages” (and no renters) you are depending on the greater fool theory to save you: you must find a greater fool than you to buy the already overpriced house at an even higher price so you can cash out. When interest rates started climbing, the music stopped and everyone scrambled for a chair. Money started to get more expensive, people stopped buying houses and anyone left with a house or two who couldn’t pay their mortgage(s) started defaulting.

I am again speaking from first hand experience. We lost our house in 2009 along with millions of others. (Well we really just gave it back to the true owner: Freddy Mac). When you play with fire and go along with the crowd sometimes you get burned and need tp lick your wounds and learn from your mistakes.

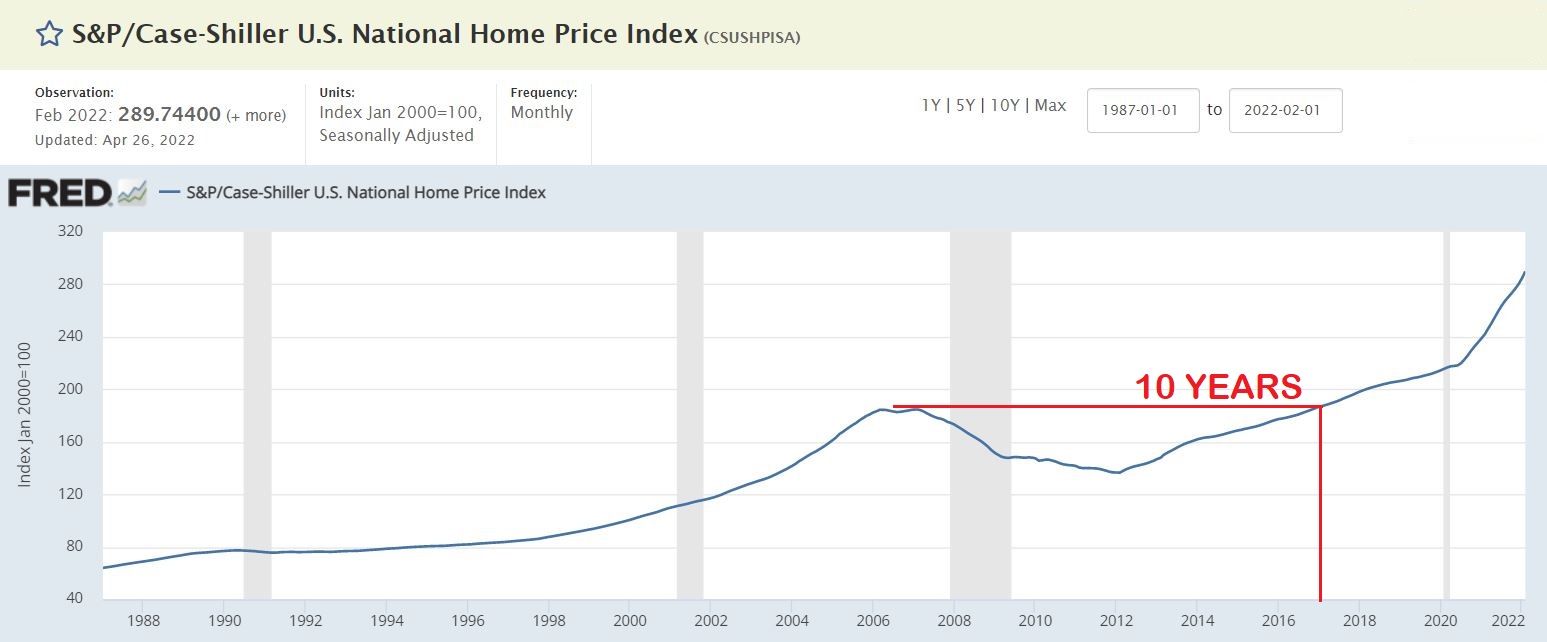

It took us personally and the nation on average, about 10 years to recover from that episode of insanity:

There is a common thread between those two events that we’re seeing in the markets today. In both instances, prices were derived from the greater fool theory. The value was not anchored (in a realistic way) to something tangible.

Sure, a house is physical and tangible, but when prices are only going up because someone with cheap money is willing to buy it, then eventually someone is going to be the last one standing without a chair when the music stops, and the price will crash.

You might have noticed in the above housing chart and NASDAQ chart, that the previous “bubbles” pale in comparison to what we see today. In other words, we are once again in a massive asset bubble. When interest rates are as low as they have been for as long as they have been, you have a lot of money chasing riskier and riskier assets (and I haven’t even mentioned crypto yet…but will in Part 2) pushing up the value of everything.

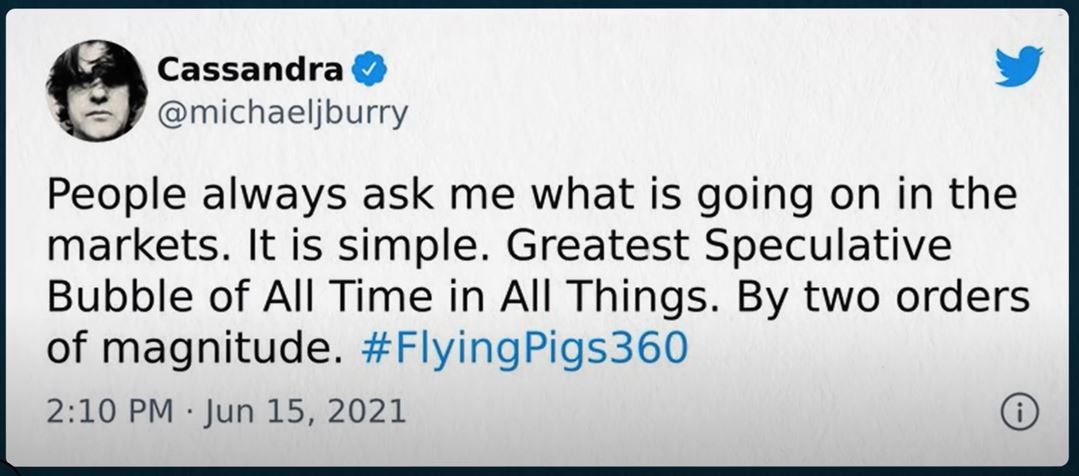

Michael Burry, the guy who saw the housing bubble before anyone else and made financial bets against it to the tune of hundreds of millions of dollars, and who the book “The Big Short” is written about (a great movie too btw) tweeted this out nearly a year ago:

So the guy that predicted the housing bubble, has been warning us of a “Speculative Bubble… in All Things” since at least last year, but most people either don’t know about it or don’t believe it. It is no wonder his username is “Cassandra” the Greek prophetess that nobody believed.

Continued in Part 2…